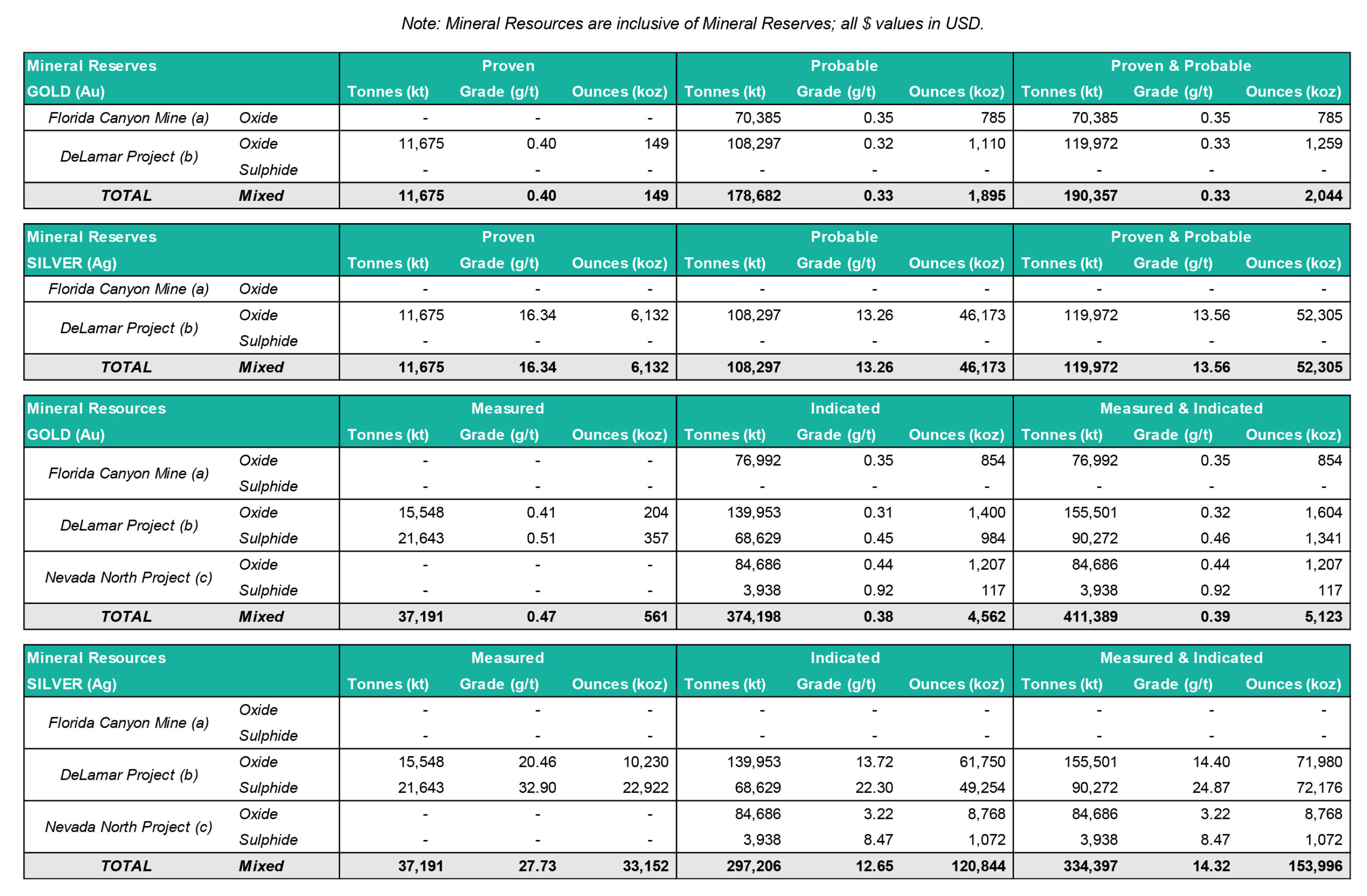

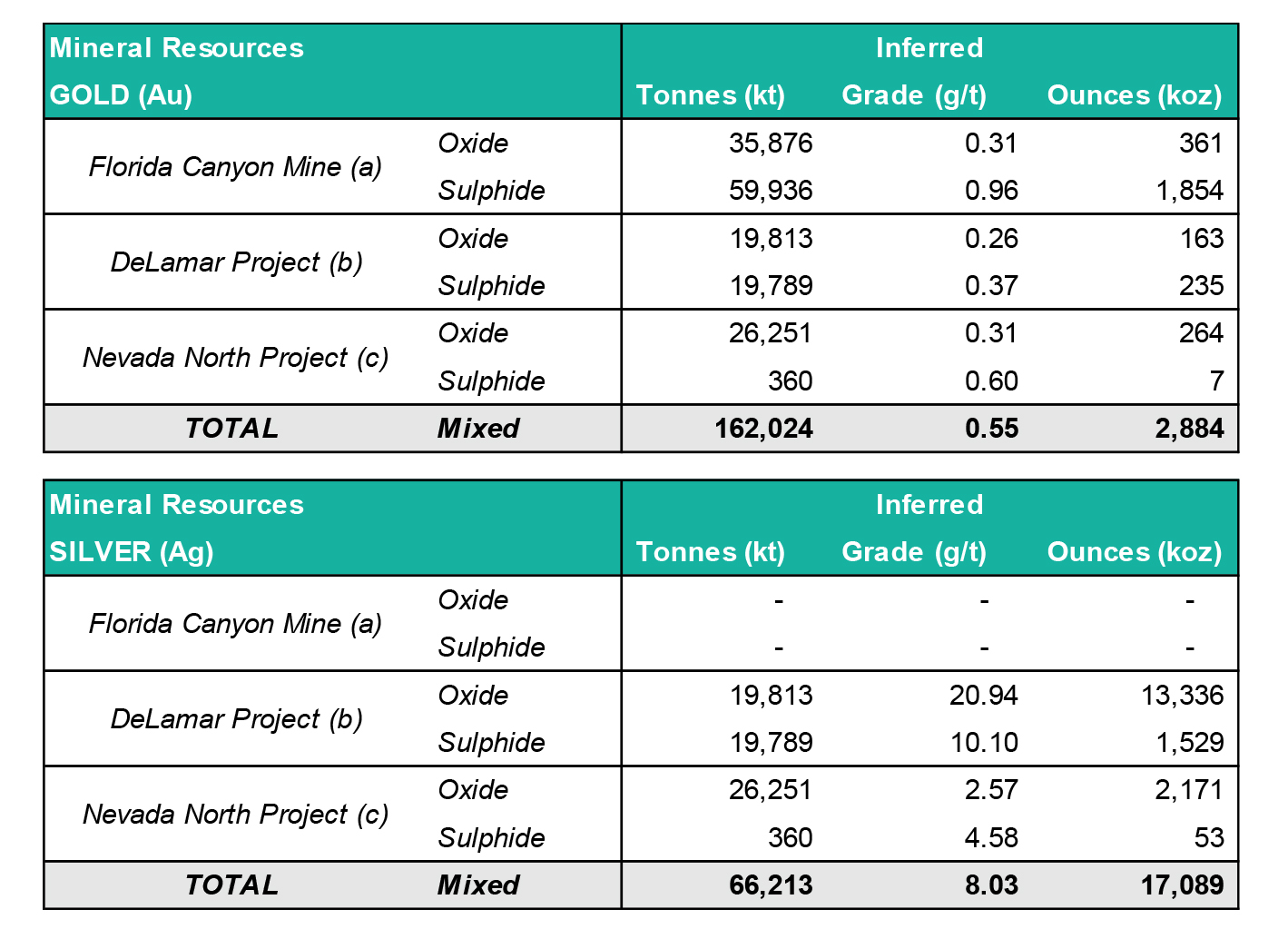

(a) Florida Canyon Mine

Notes to Mineral Reserves:

- Mineral reserves estimate has been converted into metric tonnes from short tons using a factor of 0.9072.

- Mineral reserves are reported at the point of delivery to the process plant, using the 2014 CIM Definition Standards, with an effective date of December 31, 2024. The qualified person as defined under National Instrument 43-101 – Standards of Disclosure for Mineral Projects (“NI 43-101”) for the estimate is Ms. Terre Lane, MMSA QP, a Global Resource Engineering, Ltd. employee.

- Mineral reserves are constrained within an open pit design that uses the following assumptions: gold price of US$1,800/oz considering only oxide material; gold recoveries varied by deposit and ore type, ranging from 45% to 64%; reference mining cost of $2.74/t mined in-situ and $2.08/t mined fill; processing cost of $4.97/t processed for oxide crushed material and $2.67/t for oxide run-of-mine (“ROM”) material; G&A costs of $1.20/t ore processed; treatment and refining costs of $6.57/oz gold recoverable; royalty costs of $88.00/oz gold recoverable; and pit slope inter-ramp angles ranged from 38–42° for rock and 30° for alluvium / fill.

- Mineral reserves are reported at a cut-off grade ranging from 0.13 g/t to 0.20 g/t.

- Mineral reserves include a stockpile of 1,934 kt at an average grade of 0.19 g/t and total contained gold of 11.57 koz.

- Mineral reserves include Heap Leach Inventory of 3,548 kt at an average grade of 0.29 g/t and total contained gold of 32.58 koz.

- Numbers have been rounded and may not sum.

Notes to Mineral Resources:

- Mineral resources estimate has been converted into metric tonnes from short tons using a factor of 0.9072.

- Mineral resources are reported, using the 2014 CIM Definition Standards, with an effective date of December 31, 2024. The qualified person as defined under NI 43-101 for the estimate is Ms. Terre Lane, MMSA QP, a Global Resource Engineering, Ltd. employee.

- Mineral resources are reported inclusive of those mineral resources converted to mineral reserves. Mineral resources that are not mineral reserves do not have demonstrated economic viability.

- Mineral resources are constrained within a conceptual open pit shell that uses the following assumptions: gold price of US$1,800/oz; gold recoveries ranging from 45% to 64% for oxides and 80% for sulfides; reference mining cost of $2.74/t mined in-situ and $2.08/t mined fill; processing cost of $4.97/t processed for oxide crushed material and $2.67/t processed for oxide ROM material; processing cost of $23.15/t processed for sulfide material; general and administrative costs of $1.20/t processed; treatment and refining costs of $6.57/oz Au recoverable; royalty of $88.00/oz Au recoverable, and pit slope overall angles ranging from 30–36°.

- Mineral resources are reported at a cut-off grade ranging from 0.13 g/t to 0.20 g/t for oxides and is 0.56 g/t for sulfides.

- Mineral resources include a stockpile of 1,934 kt at an average grade of 0.19 g/t and total contained gold of 11.57 koz.

- Mineral resources include Heap Leach Inventory of 3,548 kt at an average grade of 0.29 g/t and total contained gold of 32.58 koz.

- Numbers have been rounded and may not sum.

(b) DeLamar Project

Notes to Mineral Reserves:

- All Mineral Resource estimates have been prepared in accordance with NI 43-101 standards.

- Mineral Resources that are not Mineral Reserves do not have demonstrated economic viability.

- Jeffrey Bickel, of RESPEC Company LLC of Reno, Nevada, is a Qualified Person as defined in NI 43-101, and is responsible for reporting Mineral Resources for the DeLamar Project. Mr. Bickel is independent of the Company.

- “Oxide”, as listed above, is an aggregate category inclusive of all material types amenable to heap-leaching, including In-Situ Oxide, Stockpiles, and In-Situ Mixed material.

- In-Situ Oxide/Mixed and Stockpile Mineral Resources are reported at a 0.17 and 0.1 g/t AuEq cut-off, respectively, in consideration of potential open-pit mining and heap leach processing.

- Sulphide Mineral Resources are reported at a 0.3 g/t AuEq cut-off at DeLamar and 0.2 g/t AuEq at Florida Mountain in consideration of potential open pit mining and grinding, flotation, ultra-fine regrind of concentrates, and either Albion or agitated cyanide-leaching of the reground concentrates.

- AuEq was calculated using a price of $2,650/oz Au and a price of $30/oz Ag, as well as metallurgical recoveries which were variable based on spatial area and each respective oxidation zone of the deposit.

- The Mineral Resources are constrained by pit optimizations using a price of $2,650/oz Au, a price of $30/oz Ag, mining cost of $2.50/tonne, variable processing costs ranging from $3.26-$5.30/tonne, and metallurgical recoveries ranging from 45%-95% for Au and 15%-92% for Ag. Variable metallurgical recoveries and processing costs correspond to various material types including Oxide, Transition, Sulphide, and Stockpile materials, as well as spatial zones of the deposit with defined metallurgical characteristics. The pit optimizations also used a G&A cost of $0.65/tonne, pad replacement cost of $1.00/tonne for heap leach material, and refining costs of $0.00/oz and $0.50/oz for Au and Ag, respectively.

- Rounding as required by reporting guidelines may result in apparent discrepancies between tonnes, grades, and contained metal content.

- The estimate of Mineral Resources may be materially affected by geology, environment, permitting, legal, title, taxation, sociopolitical, marketing, or other relevant issues.

- Mineral Resources reported are inclusive of Mineral Reserves.

- The Effective Date of the Mineral Resource Estimate is December 8, 2025

Notes to Mineral Resources:

- All estimates of Mineral Reserves have been prepared in accordance with NI 43-101 standards and are included within the current Measured and Indicated Mineral Resources.

- Sterling K, Watson, P.Eng., of RESPEC Company LLC of Reno, Nevada, is a Qualified Person as defined in NI 43-101, and is responsible for reporting Mineral Reserves for the DeLamar Project. Mr. Watson is independent of the Company.

- Mineral Reserves are based on prices of $2,000/oz Au and $25/oz Ag. The Mineral Reserves were defined based on pit designs that were created to follow optimized pit shells created in Whittle. Pit designs followed pit slope recommendations provided by RESPEC.

- Mineral Reserves are reported using block value cutoff grades representing the cost of processing.

- The Mineral Reserves are constrained by pit optimizations using a price of $2,000/oz Au, a price of $25/oz Ag, mining cost of $2.50/tonne, variable processing costs ranging from $3.26-$5.30/tonne, and metallurgical recoveries ranging from 45%-95% for Au and 15%-92% for Ag. The pit optimizations also used a G&A cost of $0.65/tonne, pad replacement cost of $1.00/tonne for heap-leach material, and refining costs of $0.00/oz and $0.50 for Au and Ag, respectively.

- Energy prices of US$3.50 per gallon of diesel.

- Pit optimizations were run on a range of prices from $500/oz Au to $3,000/oz Au.

- The cut-off grade for Mineral Reserves is based on economics at a “Break-Even Internal” cut-off grade for the deposits.

- The Mineral Reserves purposes of reference is the point where material is fed into the crusher.

- All ounces reported herein represent troy ounces, “g/t Au” represents grams per tonne gold and “g/t Ag” represents grams per tonne silver.

- Mineral Resources reported are inclusive of Mineral Reserves

- Rounding as required by reporting guidelines may result in apparent discrepancies between tonnes, grades, and contained metal content.

- The estimate of Mineral Reserves may be materially affected by geology, environment, permitting, legal, title, taxation, sociopolitical, marketing, or other relevant issues.

- The Effective Date of the Mineral Reserves Estimate is December 8, 2025

(c) Nevada North Project

Notes to Mineral Resources:

- Mineral resources that are not mineral reserves do not have demonstrated economic viability.

- William Lewis, P.Geo, and Alan S J San Martin, AusIMM(CP), of Micon International Limited have reviewed and validated the mineral resource estimate for Wildcat & Mountain View, respectively. Both are independent qualified persons as defined in NI 43-101.

- The Wildcat Deposit estimate is reported for an open-pit mining scenario, based upon reasonable assumptions. The cut-off grade of 0.15 g/t Au was calculated using a gold price of US$1,800/oz, mining costs of US$2.4/t, processing cost of US$3.7/t, G&A costs of US$0.5/t, and metallurgical gold recoveries varying from 73.0% to 52.0% and silver recoveries of 18%. An average bulk density of 2.6 g/cm3 was assigned to all mineralized rock types. The Inverse Distance cubed interpolation was used with a parent block size of 15.24 m x 15.24 m x 9.144 m.

- The Mountain View Deposit estimate is reported for an open-pit mining scenario, based upon reasonable assumptions. The cut-off grade of 0.15 g/t Au was calculated using a gold price of US$1,800/oz, mining costs of US$1.67/t to US$2.27/t, processing cost of US$3.1/t, G&A costs of US$0.4/t, and metallurgical gold recoveries varying from 30.0% to 86.0% with a silver recovery of 20%. An average bulk density of 2.6 g/cm³ was assigned to all mineralized rock types. Inverse Distance cubed interpolation was used with a parent block size of 7.62 m x 7.62 m x 6.10 m. Rounding as required by reporting guidelines may result in apparent discrepancies between tonnes, grades, and contained metal content.

- Rounding as required by reporting guidelines may result in apparent discrepancies between tonnes, grades, and contained metal content.

- The estimate of mineral resources may be materially affected by geology, environment, permitting, legal, title, taxation, sociopolitical, marketing, or other relevant issues.

- Neither Integra Resources Corp.’s nor Micon’s qualified person is aware of any known environmental, permitting, legal, title-related, taxation, socio-political, marketing, or other relevant issue that could materially affect the mineral resource estimate other than any information already disclosed in the Nevada North Report.

- See NI 43-101 technical report titled: “Technical Report Preliminary Economic Assessment for the Wildcat & Mountain View Projects, Pershing and Washoe Counties, Nevada, USA”, dated July 30, 2023, with an effective date of June 28, 2023 (“Nevada North Report”), available under Integra’s SEDAR+ profile at www.sedarplus.ca and EDGAR profile at https://www.sec.gov