| Key Facts | |

|---|---|

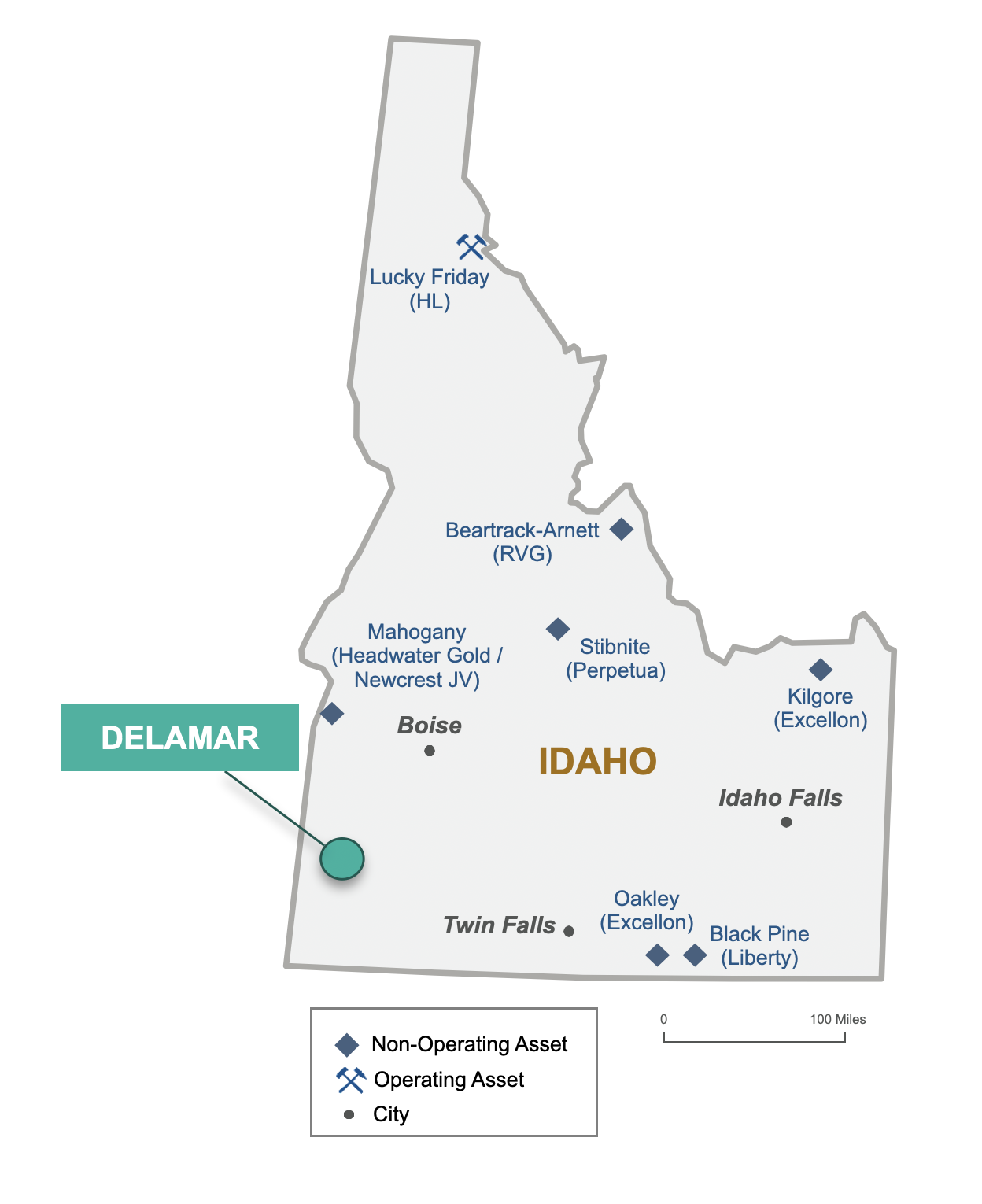

| Location | Southwestern Idaho, USA |

| Ownership | 100% |

| Metal | Gold & Silver |

| Status | Development (Feasibility Study) |

| Mine Type | Open Pit |

| Processing | Heap Leach |

| Acquisition | November 2017 |

The DeLamar Project is a gold and silver mining development project located in Owyhee County in southwest Idaho. The Project is comprised of the historic DeLamar and adjacent Florida Mountain deposits, which were previously operated by Kinross Gold Corporation. Since acquiring the Project in 2017, the Company has demonstrated significant resource growth and conversion and published robust economic studies in the maiden 2019 Preliminary Economic Assessment, 2022 Preliminary Feasibility Study, and 2025 Feasibility Study. The Project is currently being advanced through permitting with the U.S. Bureau of Land Management.

Mineral Reserves & Resources

Notes to Mineral Reserves

- All estimates of Mineral Reserves have been prepared in accordance with NI 43-101 standards and are included within the current Measured and Indicated Mineral Resources.

- Sterling K, Watson, P.Eng., of RESPEC Company LLC of Reno, Nevada, is a Qualified Person as defined in NI 43-101, and is responsible for reporting Mineral Reserves for the DeLamar Project. Mr. Watson is independent of the Company.

- Mineral Reserves are based on prices of $2,000/oz Au and $25/oz Ag. The Mineral Reserves were defined based on pit designs that were created to follow optimized pit shells created in Whittle. Pit designs followed pit slope recommendations provided by RESPEC.

- Mineral Reserves are reported using block value cutoff grades representing the cost of processing.

- The Mineral Reserves are constrained by pit optimizations using a price of $2,000/oz Au, a price of $25/oz Ag, mining cost of $2.50/tonne, variable processing costs ranging from $3.26-$5.30/tonne, and metallurgical recoveries ranging from 45%-95% for Au and 15%-92% for Ag. The pit optimizations also used a G&A cost of $0.65/tonne, pad replacement cost of $1.00/tonne for heap-leach material, and refining costs of $0.00/oz and $0.50 for Au and Ag, respectively.

- Energy prices of US$3.50 per gallon of diesel.

- Pit optimizations were run on a range of prices from $500/oz Au to $3,000/oz Au.

- The cut-off grade for Mineral Reserves is based on economics at a “Break-Even Internal” cut-off grade for the deposits.

- The Mineral Reserves purposes of reference is the point where material is fed into the crusher.

- All ounces reported herein represent troy ounces, “g/t Au” represents grams per tonne gold and “g/t Ag” represents grams per tonne silver.

- Mineral Resources reported are inclusive of Mineral Reserves

- Rounding as required by reporting guidelines may result in apparent discrepancies between tonnes, grades, and contained metal content.

- The estimate of Mineral Reserves may be materially affected by geology, environment, permitting, legal, title, taxation, sociopolitical, marketing, or other relevant issues.

- The Effective Date of the Mineral Reserves Estimate is December 8, 2025.

Notes to Mineral Resources

- All Mineral Resource estimates have been prepared in accordance with NI 43-101 standards.

- Mineral Resources that are not Mineral Reserves do not have demonstrated economic viability.

- Jeffrey Bickel, of RESPEC Company LLC of Reno, Nevada, is a Qualified Person as defined in NI 43-101, and is responsible for reporting Mineral Resources for the DeLamar Project. Mr. Bickel is independent of the Company.

- “Oxide”, as listed above, is an aggregate category inclusive of all material types amenable to heap-leaching, including In-Situ Oxide, Stockpiles, and In-Situ Mixed material.

- In-Situ Oxide/Mixed and Stockpile Mineral Resources are reported at a 0.17 and 0.1 g/t AuEq cut-off, respectively, in consideration of potential open-pit mining and heap leach processing.

- Sulphide Mineral Resources are reported at a 0.3 g/t AuEq cut-off at DeLamar and 0.2 g/t AuEq at Florida Mountain in consideration of potential open pit mining and grinding, flotation, ultra-fine regrind of concentrates, and either Albion or agitated cyanide-leaching of the reground concentrates.

- AuEq was calculated using a price of $2,650/oz Au and a price of $30/oz Ag, as well as metallurgical recoveries which were variable based on spatial area and each respective oxidation zone of the deposit.

- The Mineral Resources are constrained by pit optimizations using a price of $2,650/oz Au, a price of $30/oz Ag, mining cost of $2.50/tonne, variable processing costs ranging from $3.26-$5.30/tonne, and metallurgical recoveries ranging from 45%-95% for Au and 15%-92% for Ag. Variable metallurgical recoveries and processing costs correspond to various material types including Oxide, Transition, Sulphide, and Stockpile materials, as well as spatial zones of the deposit with defined metallurgical characteristics. The pit optimizations also used a G&A cost of $0.65/tonne, pad replacement cost of $1.00/tonne for heap leach material, and refining costs of $0.00/oz and $0.50/oz for Au and Ag, respectively.

- Rounding as required by reporting guidelines may result in apparent discrepancies between tonnes, grades, and contained metal content.

- The estimate of Mineral Resources may be materially affected by geology, environment, permitting, legal, title, taxation, sociopolitical, marketing, or other relevant issues.

- Mineral Resources reported are inclusive of Mineral Reserves.

- The Effective Date of the Mineral Resource Estimate is December 8, 2025